The recent firing of Groupon’s CEO Andrew Mason is a cautionary tale of the increased scrutiny and heightened expectations that come from accessing increasingly larger amounts of investment capital.

If Groupon remained a bootstrapped entity or a business built on the back of funds raised from friends and family, Mason would still be firmly entrenched as founder and Chief Executive. Yet despite his ability to raise over $1 billion of private equity and to build an organization that is worth $5 billion as of this writing, Mason was shown the door.

Thirteen months after raising more than $10 billion in the public markets the board forced Mason out after another dismal financial quarter.

While taking a startup public is a goal most entrepreneurs dream of, the general rule of thumb is the more capital your raise the more control you have to cede and the less tolerance your investors will have of poor financial performance. Investment capital shortens the time it takes to build a business and can give a company much needed credibility and even publicity, however, a founder should carefully weigh these seven considerations before bringing on outside investors.

1. What is your exit strategy? Contemplating an exit might be the furthest thought from a founder’s mind when launching his business, but the question should be addressed when seeking funding. An investor wants to know when they will be getting their money back and how much of a return they should expect. While taking a company public typically generates the largest return for an investor, most businesses will need to generate in excess of $100 million in revenues in order to justify the on going regulatory and filing costs a publicly traded company incurs. The fact is most start-ups that generate a positive return for their investors are acquired by corporations or financial institutions and the average time it takes a VC to make a return on their investment is more than eight years. So, whether an entrepreneur raises money or not, they have to have a long-term vision. By this measure, Groupon was by no means your typical start-up.

2. What is the company’s use of proceeds? Whether your investors set an established milestone or not you should have a clear idea of where your company currently stands in its growth phase and what it has to accomplish once the investment has been raised. Whether it is launching a website, developing a minimum viable product, making strategic acquisitions or building out your sales team the founder must have a firm understanding of what it is they want to accomplish, the value it will create and how long the milestone will take to accomplish.

3. Is outside capital really required? As a founder do you want to risk being ousted by your investor for failing to live up to their financial targets? Are you passionate about running the day to day operations of your company and the challenge of growing your business? If so then you might be better off growing organically and living without the headaches the added scrutiny outside investors bring. Many institutional investors hold the belief that founders don’t have the required skill sets, experience or temperament to run a company generating more than $10 million, let alone a publicly traded company. Such institutions will insist on recruiting a seasoned veteran as a condition of their investment and there are many investors who would point to Groupon’s Mason as a case in point.

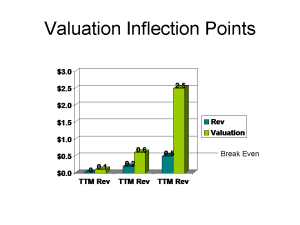

4. Does your business model scale? Many service businesses or eTailers can quickly grow to five or ten million in revenues but struggle to expand further. These limitations can frustrate investors who will need to see continued rapid growth in order to realize the returns they had been hoping for – typically five to ten times their money in five years. Failing to sustain growth will force investors to make changes at the top that will ultimately result in replacing the CEO whether he is the founder or not. Having a model that can sustain this growth will impact the type of investor you can attract and the amount of money you can raise.

5. Who should you approach, “friends and family”, passive investors or value added institutions? At Kluge the advice we give to our clients who are raising capital for the first time is to treat the exercise as they did when they first began to generate sales. Start with your friends and family and then move beyond that sphere of influence to wider circles of investors. An entrepreneur who has never raised money will have no choice but to ask the people who know and trust him or her the most. Money raised from friends and family typically come with few constraints and very simple terms. It can give you a foundation from which to launch, but usually requires subsequent rounds of capital from larger investment sources. Groupon raised seven series of private equity before going public. Wealth family officers, who manage family trust funds, are often seen as being passive investors. These fund sources may have a general industry or geographic preference, but will not necessarily place many restrictions on how a business is managed. They will require proof of a successful track record; the absence of which will make it hard to tap that source of funding. Institutional Investors, whether they be accelerators like Amplify, venture shops like Anthem Venture Partners, or even a super angel investor like Ron Conway’s Silicon Valley Angel bring tremendous value beyond the money they put into a company. Besides capital they also bring experience, industry expertise and an extensive and influential network that can quickly raise a company to the next level. Institutions are more likely to punish you for poor performance, but can open a lot of doors and shorten your growth cycle tremendously.

6. Can you afford the distraction? Raising outside funding is a huge distraction that will divert you from the day to day operations. Everyone is busy and pressed for time so when reaching out to investors make sure you do your homework and understand an institution’s investment criteria before sitting down with them. Often securing a meeting a can be a challenge unless you know somebody who can make a warm introduction. Most investors will be interested to learn what you are bringing to market, but their focus will be on your sales traction. The request to “come back in 6 months when you have more traction” is one heard by most startups raising money for the first time. The trick is to build a sense of urgency and an indication that the round is about to close and the investor will miss out if they don’t act quickly. Plan on at least three to six months of continuous meetings and pitch book revisions, if all goes well, and much longer if it does not.

7. Can you afford the delay? If you have a business that can be easily replicated like Groupon or Pink Berry there will be a huge early mover advantage that can easily be lost if you don’t raise the capital to grow and dominate your sector. Of course as Facebook and even Microsoft has shown, being first does not ensure success. The momentum Groupon gained enabled them to grow into a multi-billion juggernaut that at its core was living off the back of local merchants promoting a daily deal. If Mr. Mason didn’t raise all the outside capital on his way to Groupon’s IPO there is a good chance he would be out of business anyway, in what is now a very competitive and crowded market. While Mason might be out of a job he has walked away with over $18 million in his jeans and he still owns more than 7% of the company which is currently worth over $260 million, which is not bad for a 32 year old music graduate.

A novice entrepreneur sets out on a journey with a dream to see his or her unique solution to a problem become a reality in the market place. They have little understanding of the innumerable obstacles that must be overcome in order for that vision to enjoy widespread adoption. While an outside cash infusion can take care of numerous problems facing a fledgling business the investors will have different incentives, a different risk tolerance and must answer to different steak holders. A fuller understanding of the ramifications and complexity an outside investment brings to a startup can better help the founder find the right financial partner, minimizing the distraction and maximizing the benefits so that they can get back to the enormous challenge of growing their business as quickly and effortlessly as possible.