For the first three months of this year, I have had the pleasure of breathing the same air as the crew from Amplify, the Venice based accelerator. As a member of NextSpace I have witnessed Amplify in operation and it is a shop that definitely believes in good rewards stemming from hard work.

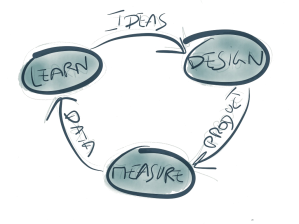

As a fourteen-year veteran of the venture industry I have often heard the phrase, “value added investors”, which is usually touted by certain VC’s as their biggest differentiating quality. Typically this means occupying a seat on the board, using recruiters to retain senior management or hiring sharp legal counsel to structure complicated deals. The value that is being “added” is often at arms length or via a specialist who interacts with the entrepreneur. At Amplify I can truly say they take the value-add approach to another level by leading by example, demonstrating what hard work and dedication truly mean while exposing their founders to influential experts and industry change makers. Amplify’s portfolio companies are schooled on every challenge they need to master in order to achieve success. And they do all this in the span of four intense months.

Amplify’s close mentoring is by design. All the companies that graduate from the accelerator’s program work from the same office and can literally reach out and touch their investors at any time. That is not to say the Partners are breathing down their neck. Like good mentors Paul, Jeff, Richard, Oded and David as well as Chris and Kris create an atmosphere in which the motivated founders can take advantage of the knowledge base to which they are exposed. But like a Darwinian experiment, the extent to which these gifts are utilized remains entirely up to each individual entrepreneur. Every graduate of the Amplify syllabus will get out of it as much as they take the time to absorb.

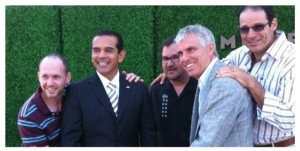

Amplify Founders with Mayor Villaraigosa

(Left to Right) Jeff Solomon, The Mayor, Richard Wolpert, Paul Bricault, Oded Noy

The Amplify partners are dedicated to helping their entrepreneurs build the best companies possible and they throw themselves into it with great passion. Jeff Solomon and Chris Olson are often the last guys to turn out the lights and the first ones in the door on any given morning. In the brief time that I have co-worked with them I have been given advice by Ann Glenn the Director of Social Media Marketing at Sony Interactive, lunched with Eric Garcetti and hobnobbed with the attorneys from Greenberg Glusker who hosted me at their swank open bar event at the Staples Center where we watched the Clippers take on the Indiana Pacers. Mogreet explained the benefits of using pictures and videos in text messaging campaigns and late in March the entire co-working space was turned into a gallery with about fifteen different artist’s on display.

About two months ago I had the pleasure of sitting down with Jeff Solomon, along with my partner, Arturo Perez. We heard how Jeff transitioned from a start-up founder to an institutional investor when he helped found Amplify towards the end of 2011. Prior to launching the Accelerator, Jeff conceived and built Leads 360 in his spare time while running his software consultancy, ThinkLogic. Jeff told us of his life-long passion for technology and start-ups, which spoke volumes about the drive, dedication and focus needed to make any business a success.

Jeff looks for these same qualities in the companies he backs. For evidence of this you need go no further than Jason Xu, the founder of Battlefy. Building a standout destination site for video gamers takes moxie in the highly competitive and lucrative on-line game industry. Jason received interest from a number of accelerators from around the country and met with about half a dozen of them before choosing Amplify. Jason said he was attracted by the energy of the partners, which he thought best mirrored the passion and drive that he brings to work every day.

Jason laughed when he told me that he has rattled off inspirational emails to Paul Bricault, Amplify’s managing director, at 11:30 at night only to find an equally enthusiastic response in his in-box five minutes later. Jason said that the dedication and commitment of the Amplify team has been extremely inspiring throughout his time at the accelerator.

If commitment and drive were Jason’s first attraction, the extensive Amplify network came in a close second. Every founder can directly access any investor or mentor in the Amplify army of cohorts, which adds up to more than 70 of the most influential business professionals in Los Angeles and beyond. The extensive list of Advisors, Mentors and Investors featured on the Amplify website is testament to the incredible number of doors that can be opened should you be lucky enough to receive a cash infusion from them.

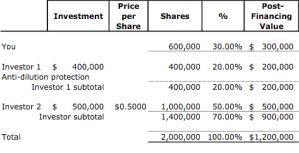

Amplify provides seed stage capital to the tune of $50,000 to $150,000 in companies with a viable product that are demonstrating some degree of traction. Besides capable entrepreneurs who have a similar drive and passion that the partners extol, Jeff looks for businesses that can scale. This is of particular concern with eCommerce businesses that can jump out of the gates at great speed racing to $100,000 or even $500,000 in monthly sales, but struggle to continue the growth beyond those milestones. Consequently, Jeff is a big believer in B to B opportunities or SaaS platforms, like Jeff’s own Leads 360.

From Kluge’s perspective, we can personally attest to the high quality of talent Amplify has backed. Whether it is the tremendous success of Amplify graduate 20 Jeans or the strategically positioned The Bouqs, every Amplify entrepreneur displays unwavering focus and enthusiasm.

Although the first draft of this post began when Kluge was a proud member of NextSpace; as of this writing we have moved to a bigger office to accommodate our expanding team. Now that we no longer commute to Windward Circle we cannot help but feel that Amplify has contributed to our growth as well. While we might not see Jeff, Paul and Chris as often as we once did, they have definitely become role models for Kluge as well.

As associate members of NextSpace we will continue to attend Amplify’s mentor series and happy hour and will gladly meet with any entrepreneurs that they support; should they need help in regards to branding, market entry penetration, digital strategy, responsive design, user experience or product development. Whether it is a thirty-minute conversation or a life long partnership we will always have time for any entrepreneurs who are putting their foot flat to the floor and are all fired up at Amplify.